It’s official: Australia loves Champagne.

Australia’s love affair with Champagne continues, with the nation popping its second-highest number of bottles in history in 2016, according to an announcement made in Germany overnight.

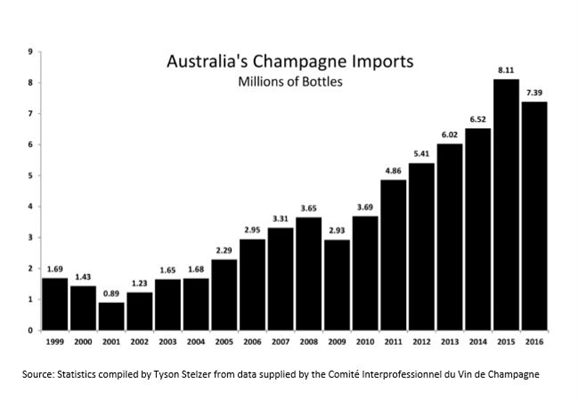

Australia remains the seventh-largest Champagne market on earth, and fifth-largest per head of population, with 7.4 million bottles landing in 2016, narrowly missing its all-time record of 8.1 million in 2015.

The new figures were released in Prowein, Germany, by the Comit Champagne, the trade association that represents independent Champagne producers.

While only topped by a year of exceptional growth in 2015, last year’s figures reveal Australia’s first drop in Champagne consumption since the global financial crisis in 2009.

However, our taste for Champagne is undeniable. In the past seven years, imports have grown by a factor of more than 2.5.

“Australia’s 2016 Champagne sales could hardly be considered a decline,” says Tyson Stelzer, author of The Champagne Guideand host of the Taste Champagne event series.

“An exceptional sales record in 2015 was an anomaly, and 2016 figures still fit Australia’s buoyant growth curve. On average, we’ve popped 600,000 more bottles every year since 2009.”

These results confirm the recent trend of Australian drinkers turning away from beer and sparkling wine in favour of more premium cuv es from the Champagne region of France.

Champagne sold 306.1 million bottles globally in 2016, marginally less than its post-GFC record of 312.5 million bottles in 2015. The biggest growth markets for Champagne in 2016 were Mexico (up 31%), New Zealand (29%), Russia (22%), South Africa (22%), South Korea (16%) and Canada (12%).

Despite the small decline in volume of sales, the average value per bottle of Champagne sold globally in 2016 rose by 1.5%.

“The diversification of cuv es is continuing in 2016: 8.6% more bottles of Champagne ros have been shipped than in the previous year, and prestige cuv es show an increase of 4.6%,” said Comit Champagne Communications Director Thibaut Le Mailloux. “Champagne consumers turn to ever rarer and more prestigious cuv es.”

Australia missed this trend toward increased value in 2016, maintaining the same average bottle price as 2015 – 7% lower than the average over the past 15 years.

“Of Champagne’s top ten markets, Australia ranks lowest in proportion of ros consumed, lowest in grower Champagne and second-lowest in prestige Champagne,” reveals Stelzer. “Our per-bottle spend remains one of the lowest in the world.”

See attachment for Champagne import data.

Source: Statistics compiled by Tyson Stelzer from data supplied by the Comit Interprofessionnel du Vin de Champagne

What's Your Opinion?