Single Touch Payroll (STP) is now becoming compulsory for businesses, which have minimum 20 employees. You will be required to report on the new system from 1st July 2018. What needs to be prepared to get ready for the new system? Would there be any impact on your business transaction or cash flow?

Here are few check points to ensure that you are ready for STP:

1. Your STP readiness: If you have 20 or more employees on 1st April in a later year, you will commence reporting under STP from the next 1st July. It means you will have a minimum of 3 months to organise your systems & procedures to meet requirement of STP.

3-month period is not sufficient to prepare thoroughly for the change if your accounting system has not been ready for STP. You should check with your software provider NOW to ensure they are STP if you plan to have 20 employees in the next 6-12 months. As a XERO Gold partner, we can confirm that XERO will be compliant with STP.

2. Your transaction accuracy: Here is the information you need to report to ATO via STP: Payment to individuals/contractor; Gross Pay/Ordinary Time Earnings (OTE); PAYG & Super. By using STP, ATO wants to get all of that information ON or BEFORE the date when the amount is required to be withheld. Generally it is the time you make payments to your employees.

Here is the challenge to accountants/payroll officers to meet this requirement. In our current practice, we process payroll on a regular basis. By month or quarter, we conduct series of reconciliations to ensure the tax withheld & Super payable amount are reconciled before reporting the information to ATO using BAS. However, using STP mean you have no room to fix the transaction before submitting to ATO. ATO has given opportunity to make correction after lodgement, however, we can see a big mentality shift for accountants/payroll officers to adapt with this change.

3. Your payment timing: Fortunately, ATO does not require business to PAY the withholding & super amount at the same time we do payroll just yet. That mean business can choose to pay together with BAS/IAS due date. However, a small legislation change in the future could easily make it compulsory for business to pay PAYG & super at the same time they pay their employees. We think that it might be the future practice. In fact, it has been implemented in many other developed countries. So what business needs to get themselves ready if this happens?

Here is a good example:

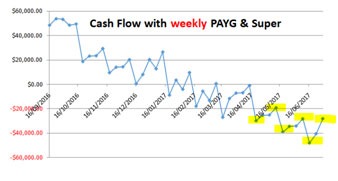

A business with salary budget of $600k per year, currently they pay $45,000 PAYG withholding + $14,250 super per quarter. If STP requires them to pay PAYG and Super at the time they do their weekly payroll, they will be required to pay additional $4,557 per week on top of their regular salary pay. As you realise how their cash flow has changed from paying $59,250 per quarter to $4,557 per week. This chart will show you the Cashflow change:

4. One positive thing: Lastly, we are glad that STP will replace end of year payment summaries which could save your accountant at least 1 day of work per year.

At Tailored Accounts, we want to ensure our client are well informed about the change in legislation, Super Stream, STP & much more updates are coming. If you feel unsure of these changes, feel free to contact us for consultation.

Harry Hoang is CEO of Tailored Accounts

“The Accounts Department of Small and Medium Business”

www.tailoredaccounts.com.au